Getting Mortgages for Properties in Flood Zones

Buying a house that's located in a flood zone won't affect your mortgage eligibility, but indirectly it is going to make the purchase more costly. If your new home is in a flood zone, your lender is likely going to require that you buy flood insurance, with an average annual premium cost of around $650, according to the National Flood Insurance Program.

Where are the Major Flood Risk Areas?

Some areas of the country are naturally higher-risk than others, and while some of these areas are obvious—like Manhattan, New Orleans, and southern Florida—there are many other locations where the risk isn't immediately apparent. It's also important to note that areas that are not currently at risk may become so over the next several decades, as a result of climate change that may alter weather patterns and sea levels in ways that increase flood risks. Several states, including Georgia, North and South Carolina, Virginia, and Massachusetts, have communities that may be affected in this way in the future.

If you're not sure whether you live in a flood risk area, there's an easy way to find out. At the FEMA website, homeowners can access flood maps that show the level of flood risk in their location. Currently, there are over 20,000 communities that are designated by FEMA as “flood zones.” Homeowners in these communities are eligible for the National Flood Insurance Program.

Why Some Mortgage Lenders Require Flood Insurance

When you get a mortgage, you're taking out a loan that uses your newly-purchased home as collateral. Mortgage lenders naturally require that your collateral be insured, because they have a significant financial interest in it—especially at the beginning of the loan term, when the lender usually has a larger financial interest in the property than the owner does.

If you live in a high-risk flood zone, you are almost always required to purchase separate flood insurance that covers the property for the entire lifetime of the mortgage. A standard homeowner's policy doesn't cover flood damage, because flooding isn't a significant risk in all parts of the country, so there's no need for it to be part of a standard policy. Note that flood damage is by definition different from water damage—a house can incur water damage in the absence of a flood, because water damage can be caused by events unrelated to flooding. For example, water damage that results from a leaking tap doesn't count as flood damage and isn't covered by the NFIP.

When does Your Mortgage Require Flood Insurance?

In the case of federally regulated or insured lenders, flood insurance is mandatory for homeowners in high-risk areas. These federal-associated lenders include institutions like Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation), the Federal Housing Administration, and the Department of Veterans Affairs. So, if you are applying for a mortgage from one of these federally regulated lenders, and the property is in a high-risk flood zone, then you are required to have separate flood insurance in order to qualify for the mortgage.

Not all lenders require that new homeowners purchase separate flood insurance. For lenders that are not federally-regulated or insured, there's no mandate that stipulates they must require flood insurance. In these cases it's up to the lender's discretion, and therefore up to the home-buyer to find out from potential mortgage lenders whether the insurance is necessary.

It's important to note, however, that properties in low-risk and moderate-risk areas are not immune to flooding and flood damage. According to the NFIP, nearly one-quarter of its claims come from homeowners who live outside high-risk flood areas. Because of this, the NFIP recommends flood insurance to all homeowners, and many lenders require homeowners purchase flood insurance even when the property is not in a high-risk area.

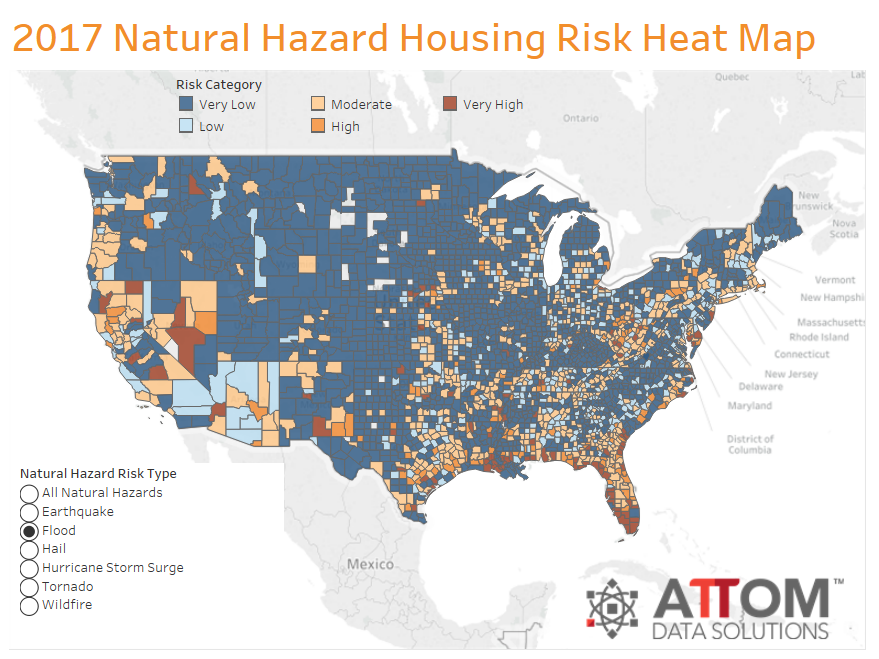

Where is Flooding Most Likely?

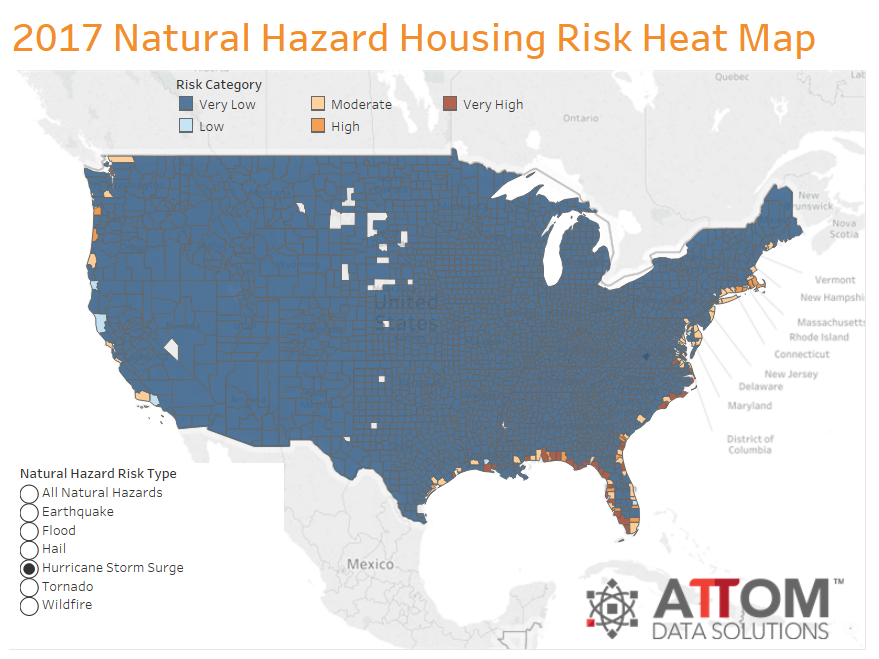

Where are Hurricane Storm Surges Most Likely?

Paying for Flood Insurance Is Required at Closing

If your flood insurance is legally mandated—that is, if you're in a high-risk zone and your mortgage comes from a federal-associated lender—then you'll probably be required to make a certain number of premium payments up front. When this is the case, those payments must usually be made at or before closing time, and an entire year's worth must be paid at this time.

The upside is, that providing the first year's worth of payments are made at or before closing, the standard 30-day wait for the policy to come into effect doesn't apply. If the premium is paid at or before closing, the flood insurance is in effect immediately at the time of closing.

Summary

- Homeowners in eligible areas can purchase flood insurance from the National Flood Insurance Program

- If your mortgage lender is federally-regulated or insured, you must buy flood insurance if your property is in a high-risk flood zone

- If your lender isn't federally-associated, or you're not in a high-risk zone, you may not be required to buy flood insurance

- The NFIP strongly recommends homeowners buy flood insurance even if they're not in high-risk zones, because flood damage occurs even in low and moderate-risk zones

- In most cases a homeowner is required to pay the first year's worth of premium payments at closing